PCCA Cotton Market Weekly

Posted : November 16, 2024

July 12, 2024

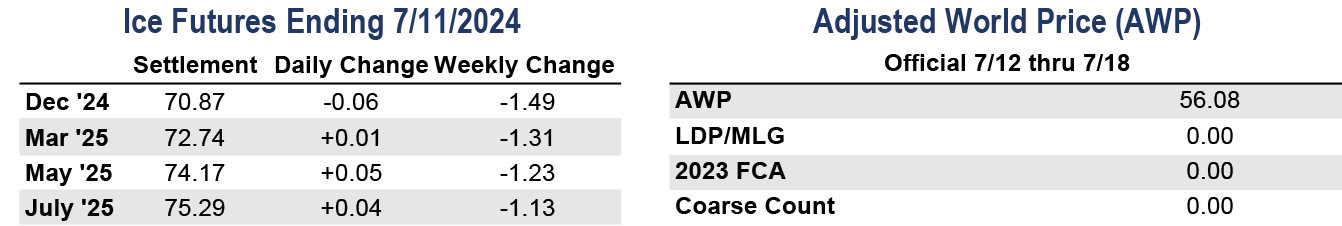

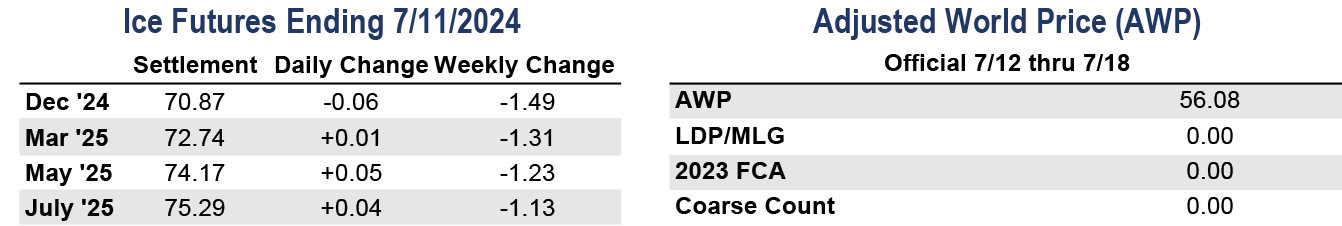

Cotton futures traded on both sides of the market ahead of Friday’s WASDE Report.

- The summer doldrums were present this week, evident by the market’s daily two-sided moves and the December contract reaching a three-year low.

- December futures settled 149 points lower at 70.87 cents per pound.

- Favorable weather in Texas, speculative short coverings, and macroeconomic data contributed to this week’s price struggle.

- The CFTC Cotton On-Call report showed an imbalance of 57,034 unfixed on-call sales compared to 81,536 unfixed on-call purchases.

- Trading volumes were light, but the total number of open contracts increased by 5,152 to 215,200.

- Bales eligible for delivery against futures continued to decrease. This week, 11,933 bales were decertified for delivery, reducing the total certificated stock to 41,858.

- The quality of the U.S. crop decreased this week, dropping from 50% rated good to excellent to 45%. Cotton rated good to excellent in Texas fell to 35%, Oklahoma increased to 71%, and Kansas increased to 57%.

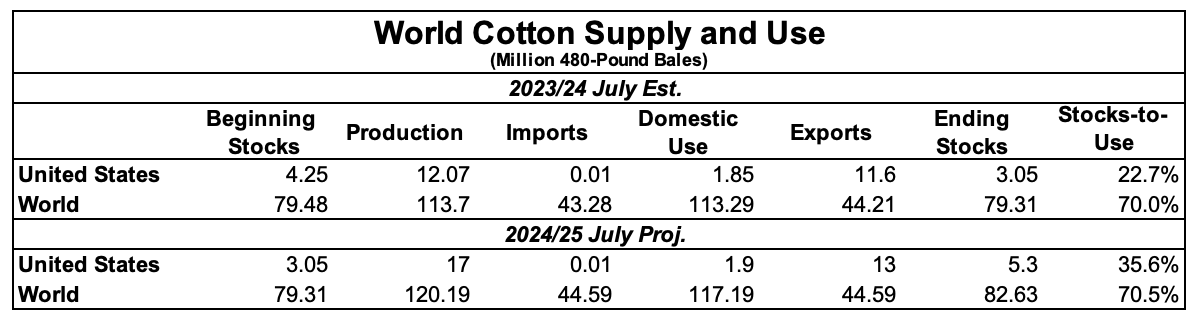

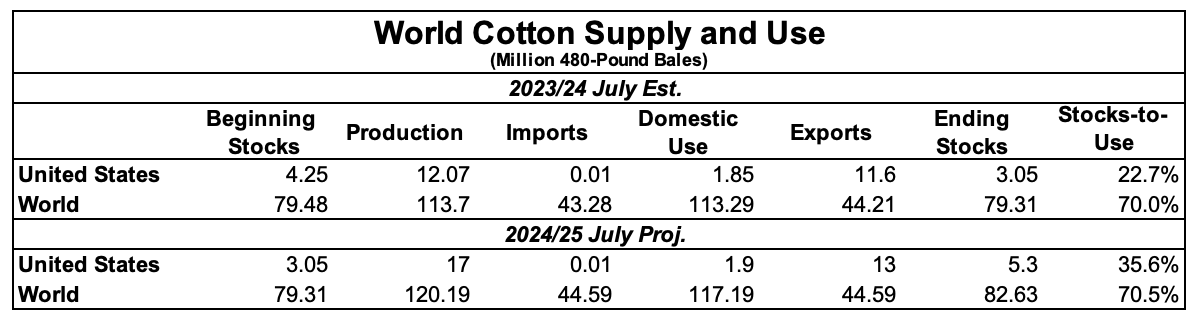

The July World Agriculture Supply and Demand Estimates were in line with expectations.

- The one notable change for the 2023/24 U.S. crop was the decrease in exports, which decreased 200,000 bales to 11.6 million. The decrease was not a surprise, given the slow pace of shipments in the previous month.

- For the 2024/25 U.S. crop, USDA raised production one million bales to 17 million, an anticipated increase after the surprise upside in last month’s acreage report. This change flowed into ending stocks, which increased by 1.2 million bales to 5.3 million bales.

- There were no notable changes to report on the global side of the balance sheet.

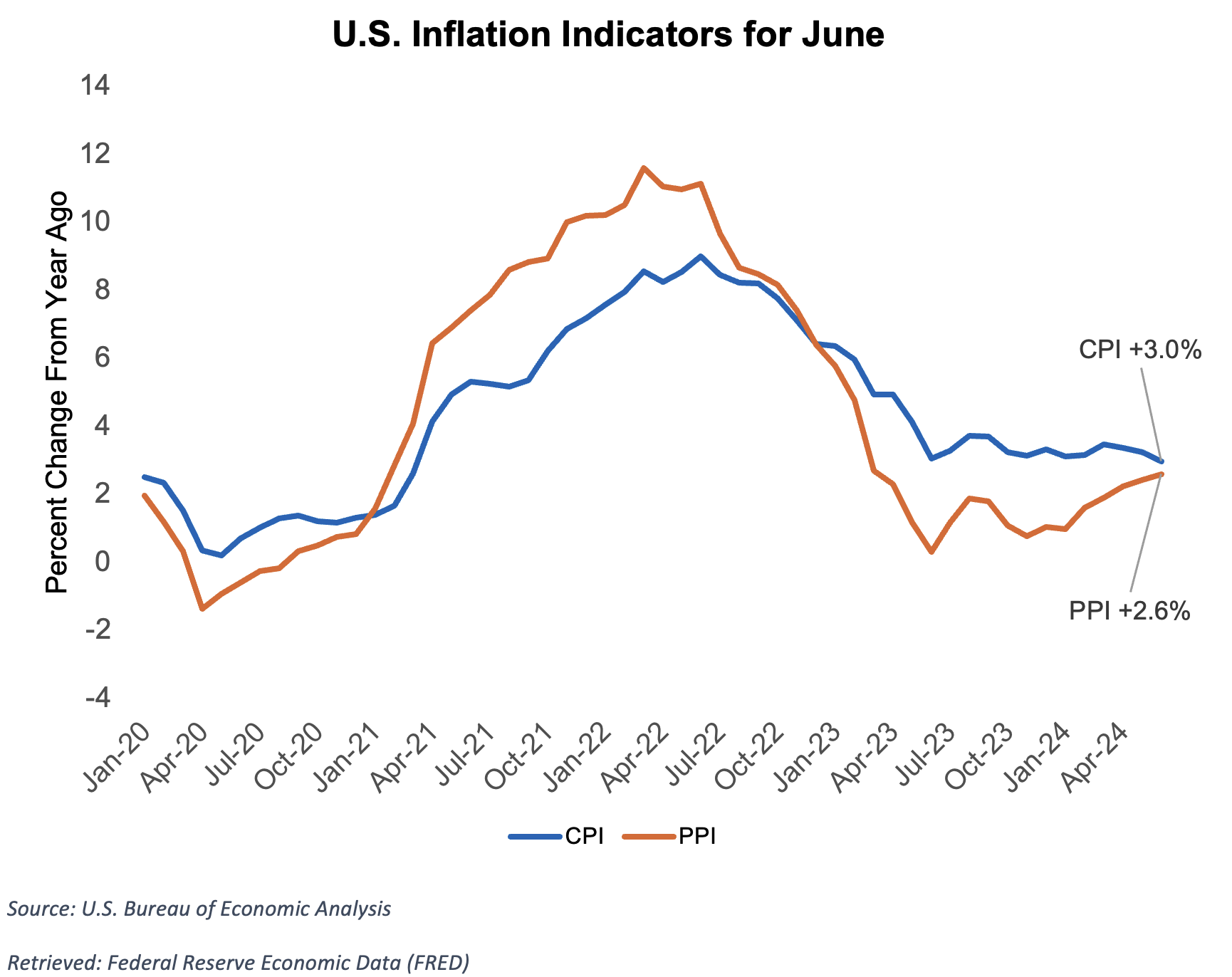

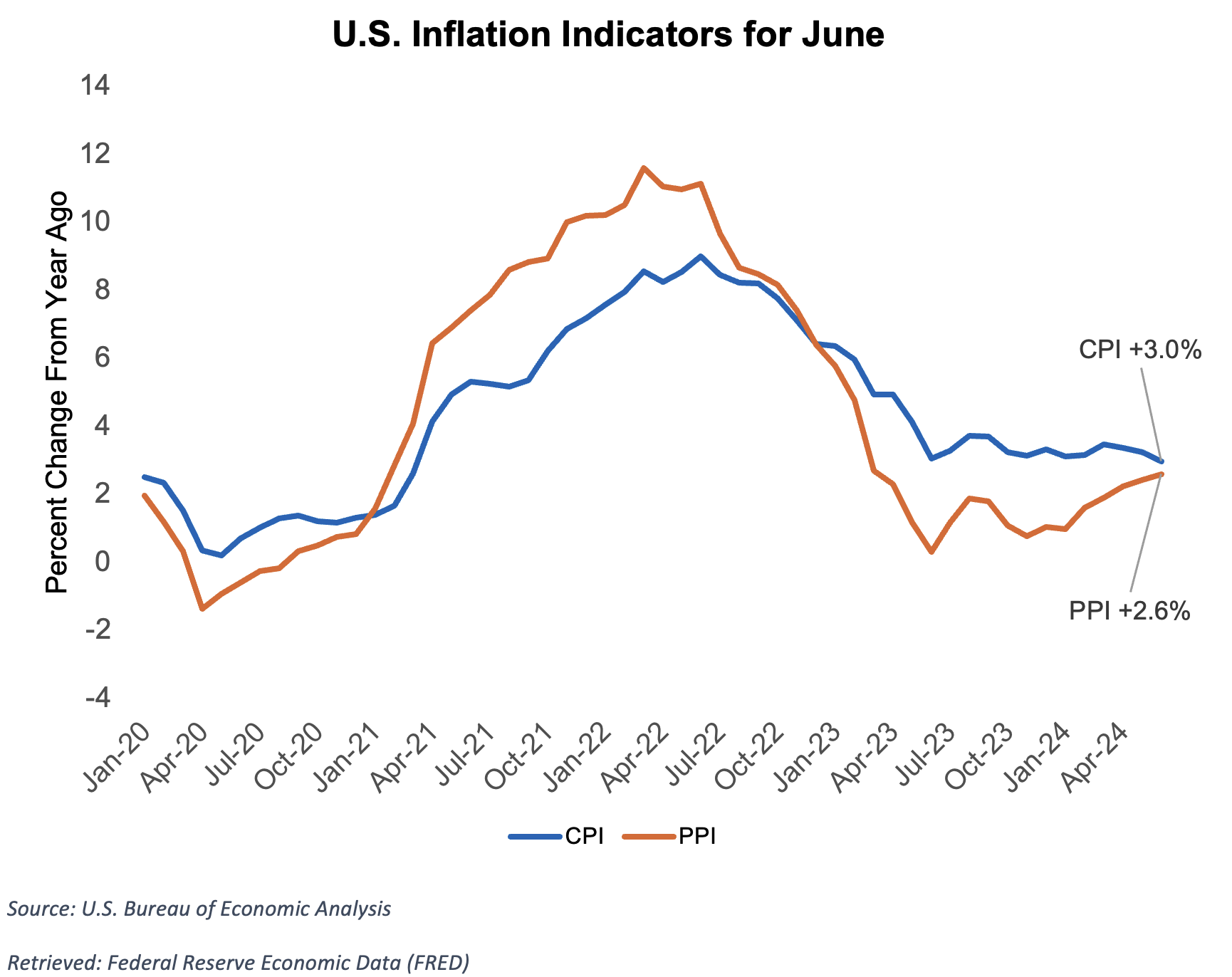

U.S. consumer inflation eased more than expected, leading many to believe the Fed will begin to cut interest rates earlier this year.

- The U.S. Consumer Price Index (CPI) eased to 3.0% year-over-year, better than expectations of 3.1%. Month-over-month, it was down 0.1%.

- The U.S. dollar fell under pressure late in the week due to the softer economic news, which helped support commodities.

- Fed Chair Powell testified to the Senate Banking Committee this week and advised that he wanted to avoid sending signals about the timing of interest rate cuts. He noted more balance in the labor market but emphasized that the FOMC cannot focus solely on inflation going forward.

- The U.S. Producer Price Index (PPI) increased more than expected, rising 0.2% month-over-month and 2.6% year-over-year.

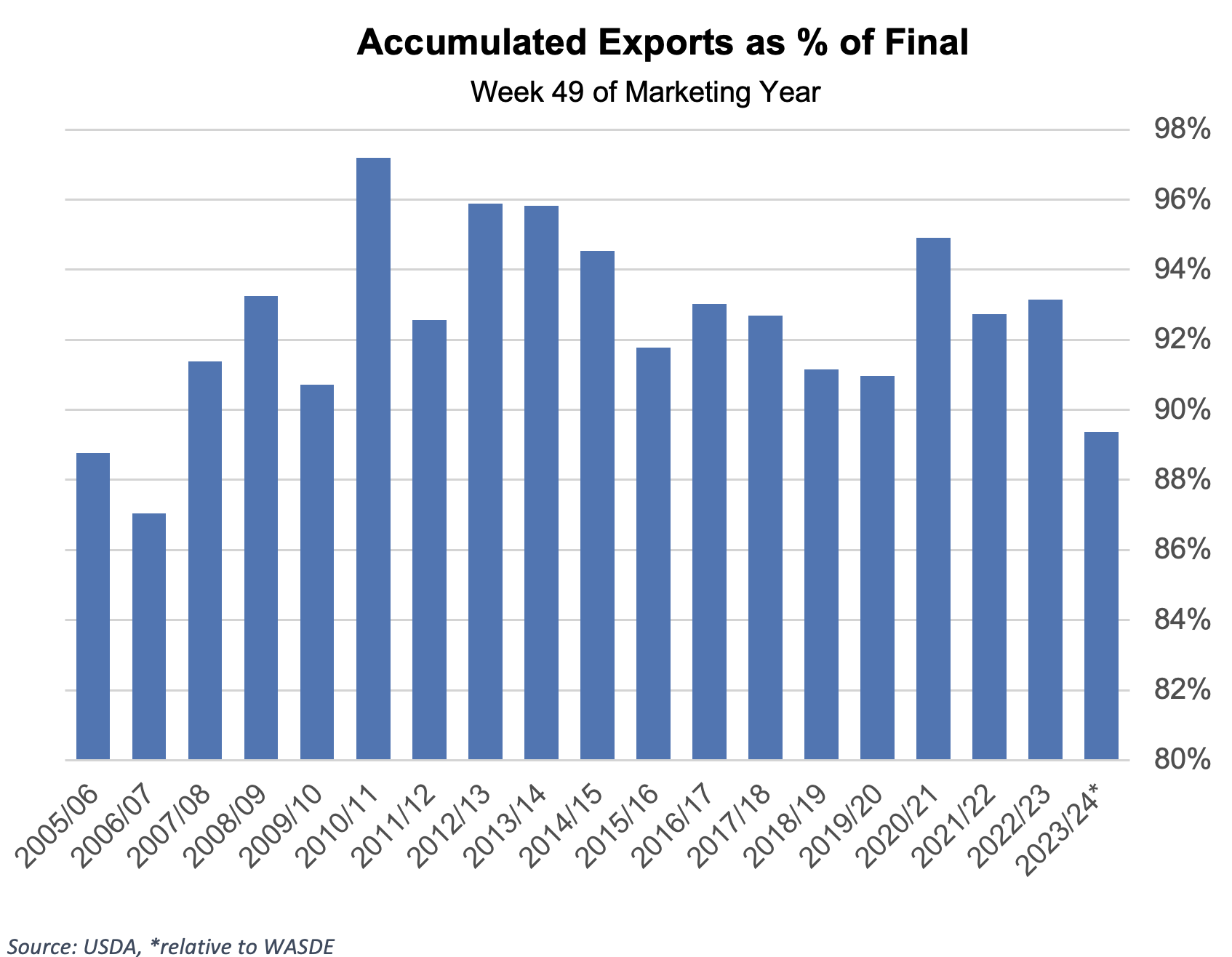

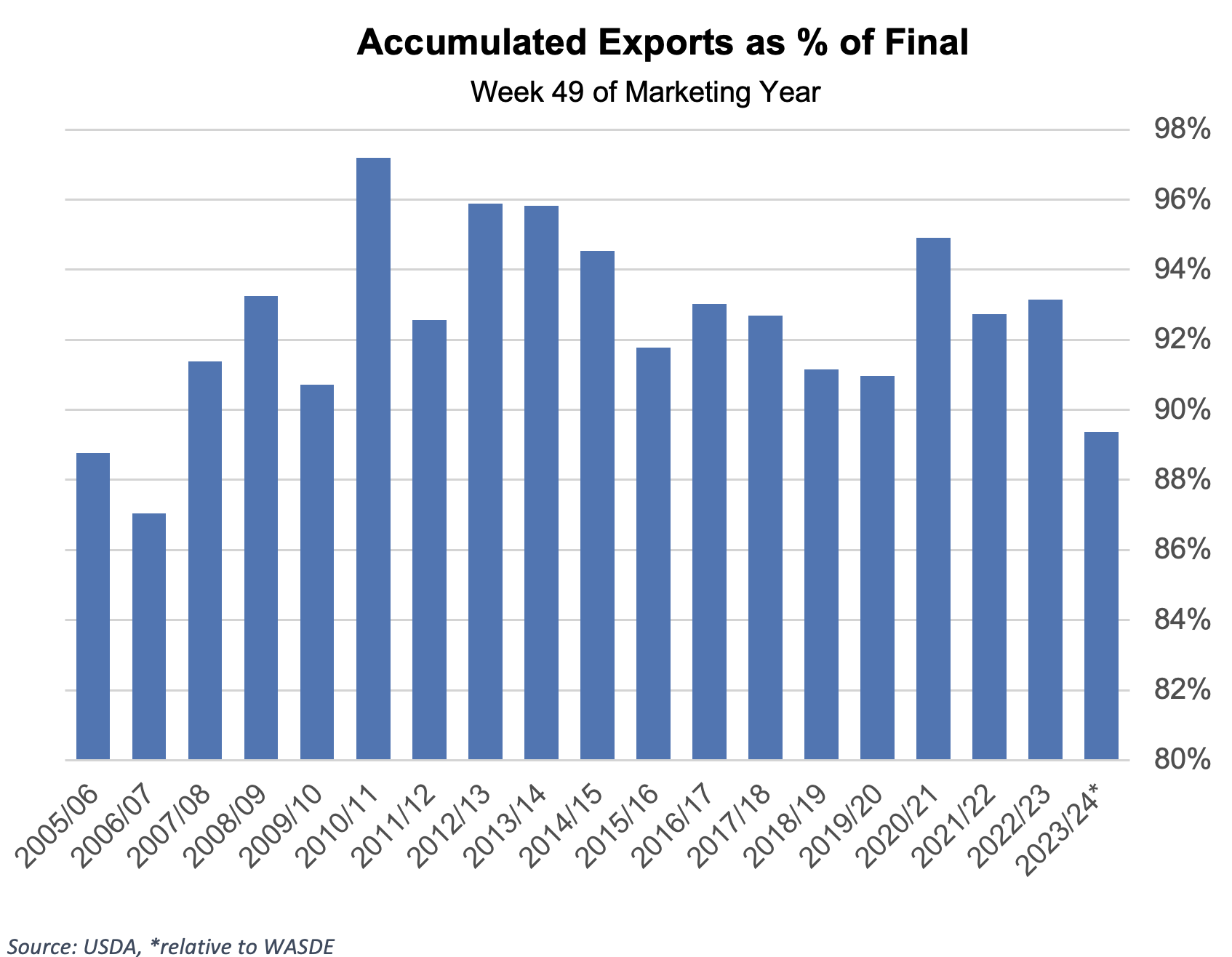

The U.S. Export Sales Report showed light sales and modest shipments for the week ending July 4.

- For the current crop year, U.S. exporters sold a net total of 54,100 Upland bales. Traders hoped to see better demand for new crop, but the 69,500 bales sold were slightly disappointing.

- With less than three weeks left in the marketing year, the modest 160,700 bales exported during the week are inadequate to reach USDA’s export estimate.

- Pima merchandisers sold 3,900 and exported 1,900 bales.

The Week Ahead

- Next week will be a slightly slower week for data releases. June retail sales will be released in addition to the usual reports on crop progress and condition and export sales.

- Hurricane Beryl brought high winds and heavy rains to South Texas, but the crop seems to have fared well overall. West Texas saw scattered storms throughout the week, bringing hail to some areas. Much of the cotton-growing regions in the Southwest received some moisture in the past week.

The Seam

As of Thursday afternoon, grower offers totaled 17,193 bales. On the G2B platform, 1,343 bales were traded during the week, averaging 70.38 cents/lb. The average loan was 53.52, resulting in an average premium received over the loan of 16.86 cents/lb.